Overall, most trade analysts agree that the Section 301 tariffs have not succeeded in decoupling the U.S. and Chinese economies. Rather, they have highlighted some industries and sectors where the U.S. is still heavily reliant on China and where other countries and domestic sources may not be able to meet U.S. demand.

In 2017, the U.S. implemented punitive tariffs on products of Chinese origin following an investigation under Section 301 of the Trade Act of 1974. These tariffs were implemented beginning in 2018 and 2019 through a series of lists covering over $350 billion worth of goods. As the United States Trade Representative (“USTR”) continues its statutorily required four-year review of the effectiveness of these tariff measures, it initiated a request for comments and issued a stakeholder questionnaire to examine the effectiveness of the tariffs in achieving the objectives of the original investigation. USTR also requested input on other actions that could be taken to address trade with China and the effects of the tariffs on the United States economy, including businesses and consumers. However, according to the Peterson Institute for International Economics’ article Four years into the trade war, are the US and China decoupling?, trade trends four years after implementation seem to reveal that the U.S. may be more reliant on China than was originally anticipated.

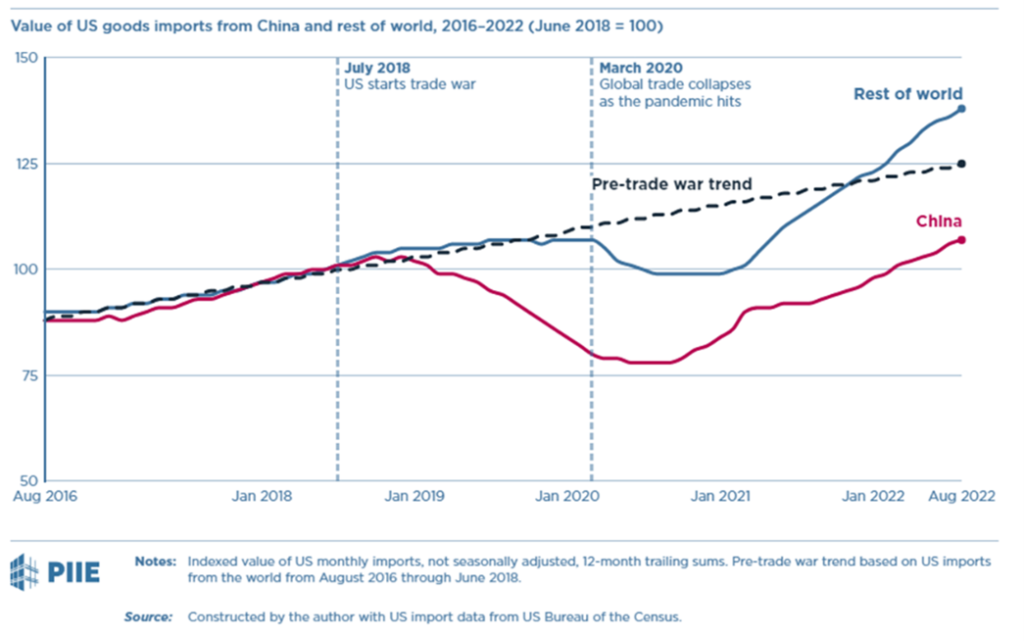

Though U.S. imports of Chinese products subject to these tariffs sharply declined in 2018 shortly after implementation, trade activity since then has continued to rise. China is currently the source of 18% of total U.S. imports. This upward trend, and continued reliance on China, is likely due to importers finding practical means of relief, such as seeking exclusions from these tariffs for their imported products and implementing numerous duty mitigation strategies, such as tariff engineering, FTZs and drawback, to help offset some of the increased cost of procurement from China. Further, some importers are stuck paying these additional tariffs because sources of their goods outside of China are not available or not viable.

While U.S. imports of Chinese products subject to Section 301 tariffs were drastically reduced, U.S. imports of Chinese products that were not subject to these tariffs surged. This development is clearly seen in the import data of laptops, monitors, video game consoles, and smart phones, all consumer goods which have been spared. Throughout the Covid 19 pandemic, China remained a consistent source of these items, suggesting the U.S. is, and will remain, heavily reliant on China.

Many other countries were able to fill gaps in supply left by decreased imports from China. U.S. imports from the rest of world are 38% higher than before the tariffs were put in place; however, these other economies were not always able to meet the growing U.S. demand. This trend is evident when you look at the import activity of semiconductors. While import volumes from China have fallen from 47% to 39%, volumes from the rest of world have only grown by 5%. This is due to China’s ability to produce “legacy” chips for low profit margins while competitors in other countries did not have much interest in switching to these less profitable products.

Overall, most trade analysts agree that the Section 301 tariffs have not succeeded in decoupling the U.S. and Chinese economies. Rather, they have highlighted some industries and sectors where the U.S. is still heavily reliant on China and where other countries and domestic sources may not be able to meet U.S. demand. The current administration has largely continued the trade policy with China put in place by the prior administration and has not indicated that the tariffs will be removed or altered in the near future. Meanwhile, the USTR sought additional insight and data from stakeholders to better understand the broader economic and industry specific impacts of these tariffs. While U.S. importers must continue to navigate the global procurement landscape with these tariffs in play, the USTR’s analysis may provide a central opportunity to understand the effects of the tariffs to US operations and perhaps shape the direction of any potential changes to U.S.-China trade policy.

Create networking & educational opportunities on a wide variety of international topics.

Discover MITA events